In a previous blog post I talked about the FIRE (Financial Independence Retire Early) movement. One bit of information I have gleaned over time from this movement is the tendency to live your life being more conscious of ways to do more while spending less. And yes, this also applies to investing. Nobody likes wasting money, but those in the FIRE movement also like to take control of managing their own finances versus paying financial advisors who might charge 1-3% per year of the value of your assets under their management.

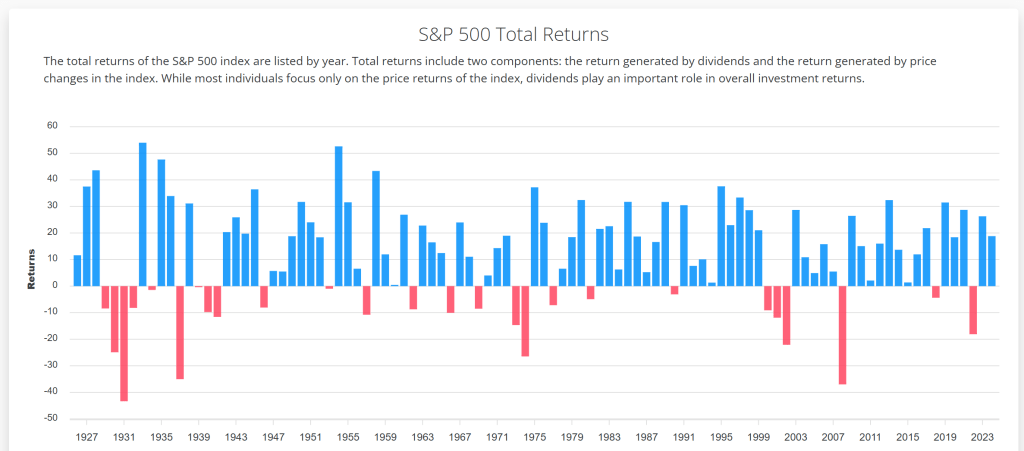

One investment topic and recommendation that seems to come up often in FIRE chats is the popularity of mutual funds that track the S&P 500 index. Here’s why – since the beginning of this index being used to track stock performance the historical performance or rate of return has been over 10%. This means that if you have been invested in this fund, per the Rule of 72, you would have on average, since its inception, doubled your money roughly every 7 years. That alone is reason enough to take a closer look. (Historical performance chart below – source SlickCharts).

Simply stated, the S&P 500 Index looks to track the performance of the 500 largest companies that trade in United States Stock Markets. It was started in 1957 by Standard & Poor, a financial company that has been analyzing financial markets since the 1800’s. How the Index works is that it uses a weighted method meaning that the larger the company is the more weight it has toward the daily indexed value.

So, what some investment companies (e.g. Fidelity, Schwab, Vanguard, etc.) have done is to create mutual funds solely comprised of the stock holdings of these 500 companies. The holdings, following the index, are weighted too, meaning that the larger the company the more of its stock is held in the mutual fund. Because it follows an established index these mutual funds don’t need high priced money managers to make trading decisions. Instead, they rely on the index as a guide. This keeps management fees very low which in turn can give you a greater return on your own investment as compared to other more heavily managed growth focused mutual funds.

By their simplistic nature alone, S&P 500 index funds seem to be a good place to start for those rather new to investing and where I first dipped my toe. The common disclaimer in investing is that past returns are not indicative of future performance, but I have to believe that an average return of 10% over 67 years is a pretty impressive performance record. That’s why a big part of my self-managed portfolio has been invested in S&P 500 index funds for the past 15 or so years. Some may say it’s lazy investing and that better returns can be had elsewhere, but I like the ease and simplicity of it combined with a rate of return that I find to be most favorable.

To be perfectly clear the 10% return is just an average. You can be up 30% in one year and then down 20% in the next. You have to be able to weather market ups and downs and stay in it for the long run in order to achieve an average positive gain.

One criticism that I have heard is that S&P 500 index funds suffer from not being diversified enough as currently their top 5 holdings (Apple, Microsoft, NVIDIA, Amazon, and META) make up over 25% of the fund’s overall holdings. If you are more risk-averse, then there could be some merit to this, and you might want to consider other, more diversified, funds.

Like me, if these types of funds seem to fit your investment goals, time horizon, and level of risk tolerance then they might be a smart choice for you. Here are some of the ticker symbols for some of the more popular S&P 500 index funds:

- FXAIX Fidelity’s S&P 500 Index Fund

- SWPPX Schwab’s S&P 500 Index Fund

- VFIAX Vanguard’s S&P 500 Index Fund

Leave a reply to coralhearta5c6c1163c Cancel reply