Happy New Year! Let’s hope that the new year brings good health and much prosperity.

Speaking of prosperity, one thing that I like to do at the start of every new year is to take the pulse on my financials – specifically to see where I am year over year. Why do this? Well, I hope to be at or above where I was a year ago and this allows me to do a health check. Also, it helps me to better plan for the coming year with respect to budgeting. If my net worth has grown quite a bit more than expected, then I can choose to allocate more to discretionary spending. If I am down, or in the red as they say, then I can choose to tighten my belt until things approve. To be honest I like to do a health check multiple times a year but then lock in the final numbers around the first of the year. This gives me a nice running history of my net worth.

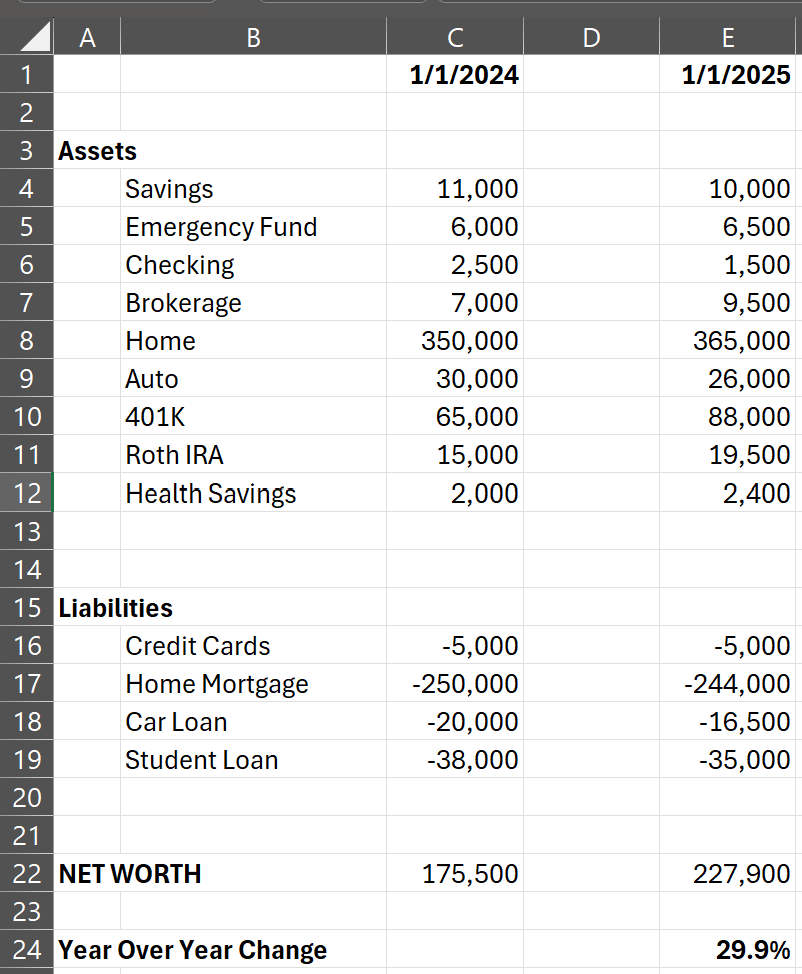

Here’s how I like to do it. I set up an Excel spreadsheet for this, but if you aren’t comfortable with Excel then a sheet of paper or spiral notebook would work fine. On my sheet I set up a group of rows as my Assets (what I own) and another group as my Liabilities (what I owe). The difference between the two is my Net Worth. I use a column to represents a distinct year, so over time I can track my net worth year over year and easily see if I am doing better or worse.

Here is an example of such a tracking sheet.

The information that I entered in this example is pretty self explanatory and you can certainly add/delete/customize the rows for your own personal situation. What I do typically, after locking in the new year numbers, is to add a next column for the current year and then I update it periodically throughout the year just to be certain that I don’t have to adjust my budget in any way.

Hopefully you find this little exercise valuable and helpful when performing your own financial health checks.

Leave a comment