I’m a math guy. I like data. I like facts. I don’t love risk, but I do favor calculated risk.

So, let’s talk about Monte Carlo simulations. What exactly is it? A Monte Carlo simulator is a mathematical model or algorithm that uses historical data mixed with a series of variable inputs to predict the likelihood of an outcome. Before I lose you, in simplified terms, a Monte Carlo simulator can help you understand how your money can grow over time and the probability that you may run out of it based on your withdrawal rate along with historical stock market returns.

Firstly, let me say that there are many FREE Monte Carlo simulators available online. You don’t need to purchase them, nor do you need to pay for and visit a financial advisor to use one. Essentially, a simulator is just a computer program.

What I love about Monte Carlo simulators is that you can input information specific to your situation and tweak it in any number of ways to see how it affects the probability of an outcome. Typically, the simulators allow you to enter information like:

- Current Age

- Current Savings

- Projected Retirement Age

- Projected Withdrawal Rate in Retirement

- Projected Income in Retirement (e.g. Social Security, Pension, Inheritance, etc.)

- Projected Rate of Return in Retirement based on your level of risk.

- Projected years in retirement that you need your money to last (i.e. your life expectancy)

The program then runs through a series of calculations and spits out some graphs and probabilities of whether your money will indeed last through your life expectancy. One of my favorite online tools is called FIRECalc. It’s a very popular tool for anybody interested in financial independence and retirement.

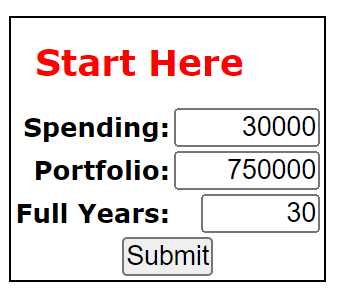

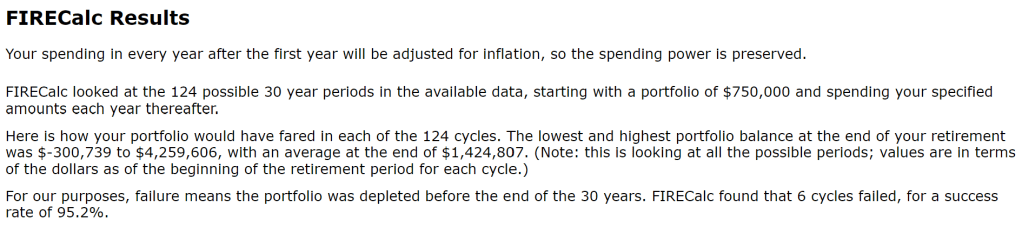

Using this tool you can start by simply entering 3 pieces of information – Spending (what you plan on spending yearly), Portfolio (how much savings you have), and Full Years (how many years will you be spending that amount). It will then open a new window with the results of its calculations and project the probability that the Portfolio will last for the Full Years specified. Note: if you don’t specify otherwise the Firecalc tool assumes a portfolio of 75% stock index funds and 25% bonds. Here is what the simple, default input box looks like along with the corresponding results –

Pretty col huh?

This is an easy first step just to see how the simulator works, however you will likely want to access the other tabs in Firecalc to customize the inputs to your specific Portfolio and projected income and rate of return. Firecalc also allows you to apply different spending models to the calculations. The default model assumes consistent spending during your lifetime, but many people believe that their spending will decrease with age, so you can choose other models to support this.

I recommend playing with all of the different scenarios to see what your potential outcomes might be. Typically, what I do is to tweak the inputs and spending models so that I have at least a 95% degree of success with the most conservative model. In doing so I feel a great deal more comfortable that my savings will last me through retirement and perhaps allow me to withdraw more than the simple 4% rule suggests.

Leave a comment