The concept of budgeting seems to be a foreign concept to most people. Admittedly, I didn’t know much about it myself. I first learned about it from my Dad (there’s a pattern here) at a very young age. From age thirteen to sixteen years old I had a morning paper route. My alarm went off daily at 5am and I rode my bike with a sack full of 35 newspapers approximately a half mile away to the start of my route. I was pretty much done by 6am every day. Then at least once a week I would go back in the evening and knock on my customers’ doors to “collect” the weekly fee for delivering their newspapers. You’d be surprised at how many folks pretended not to be home so that they owed me 4-6 weeks worth of fees by the time I was able to get ahold of them. Some customers on the other hand would pay ahead for the next 3 weeks. So, from a money standpoint sometimes it was feast, but more often than not it was famine. The real problem with this was that each and every Saturday morning I’d have to go to newspaper company’s main office in town to pay the weekly bill for all those newspapers – whether I was able to collect the money or not. At age 13, I just really couldn’t figure out how to manage it week to week.

It was then that my Dad came to the rescue. He said that we are going to figure out a budget. Essentially, I personally got paid from the difference between what I collected from customers and what I owed the newspaper company, plus whatever tips I got. Some weeks $30 was leftover and some weeks I only got $2. What Dad suggested I do was to pool all incoming money every week in an old cigar box, pay my bill from those funds, and only take $18 as a weekly salary. Eventually, the pool of money might grow enough such that even during lean collection times I could pay my bill, take my weekly salary, but also have plenty leftover. In that case I gave myself a bonus from the cigar box of maybe $10-$20 every few months. Ultimately, we established a budget where I could take a consistent weekly salary while also paying my weekly obligations.

So, in its most simplistic form that’s what budgeting is all about – determining what you have coming in and managing your obligations of what is going out. Certainly it can vary weekly or even monthly but that’s ok. Budgets don’t have to be perfectly accurate. Nobody expects you to be an accountant. The point though is to establish some guardrails to help guide your spending habits in a more organized way.

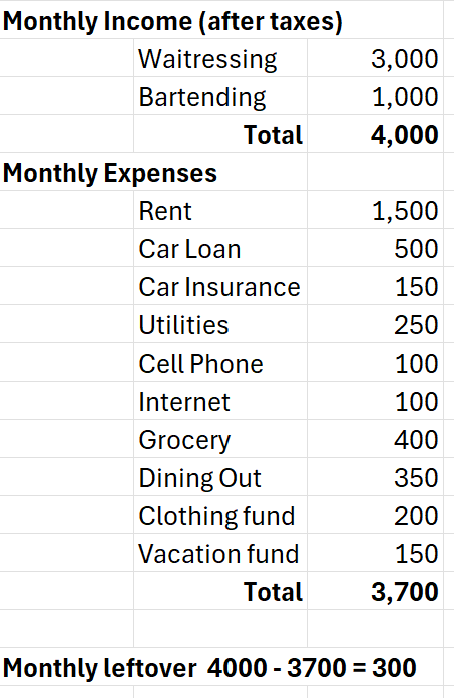

You might be thinking that budgeting sounds cool but where do I start? In it’s easiest form you could take a sheet of paper and a pen and list all your monthly income sources and amounts and then all your outgoing payments and amounts. Your income minus your expenses is what you have left at the end of the month. Hopefully, it’s a positive and not a negative number. Here’s an example:

It’s really just that easy and probably better to use a pencil versus pen so that you can make changes. If you have access to a spreadsheet tool like Excel then it makes this task super easy. And if you want to really get crazy, there are mobile apps out there that you you can use to create budgets as well as categorize and automatically track your expenses.

Whatever method you choose the sooner in life you learn how to properly create, track, and hopefully stick to a budget the better off you’ll be both financially and emotionally.

Leave a comment